The Beneficial Ownership Information Reporting Form (BOIR) offered by FinCEN.gov is a form that requires certain companies in the US to share details about their beneficial owners—the individuals who own or control the company.

The main objective is to increase transparency and prevent illegal activities such as money laundering and fraud. For companies, complying with BOIR is essential to avoid legal issues and maintain integrity. This article will address everything you need to know about BOIR in detail.

Who Needs to File the BOIR?

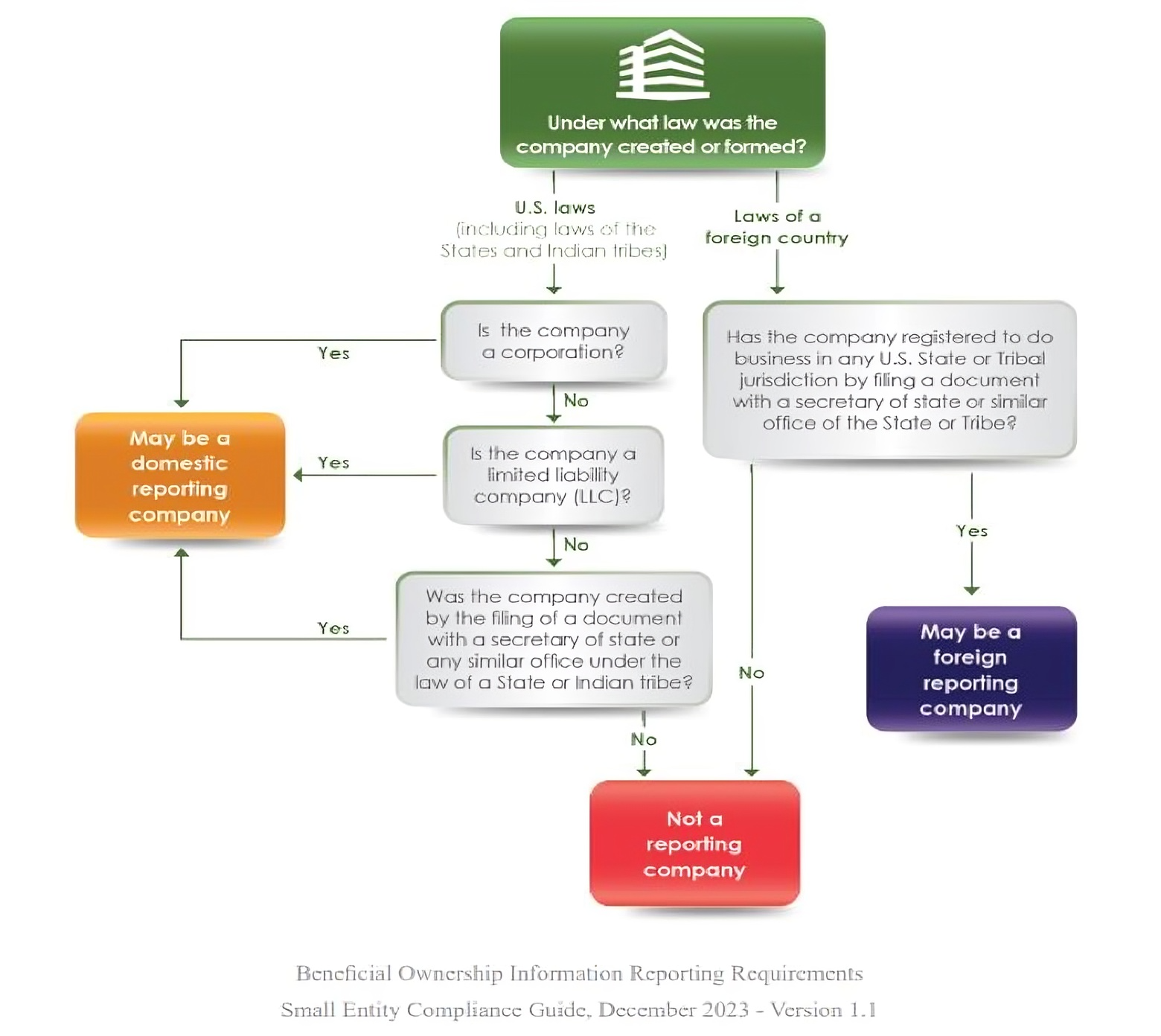

Most domestic and foreign companies in the US that fall under the definition of a reporting company are required to file the Beneficial Ownership Information Reporting Form (BOIR). This applies to:

- Domestic reporting companies: These are companies that come into existence through filing a document with a secretary of state or similar office under the law of a state or Indian tribe.

- Foreign reporting companies: These companies register to do business in the United States by filing a document with a state or tribal office, following the law of that state or Indian tribe. If not, it is not a reporting company.

If your company doesn’t qualify as either a “domestic reporting company” or a “foreign reporting company” based on the definitions or if it qualifies for an exemption, you don’t need to file a BOI report with FinCEN.

To determine if your company needs to file the BOIR, follow this flowchart:

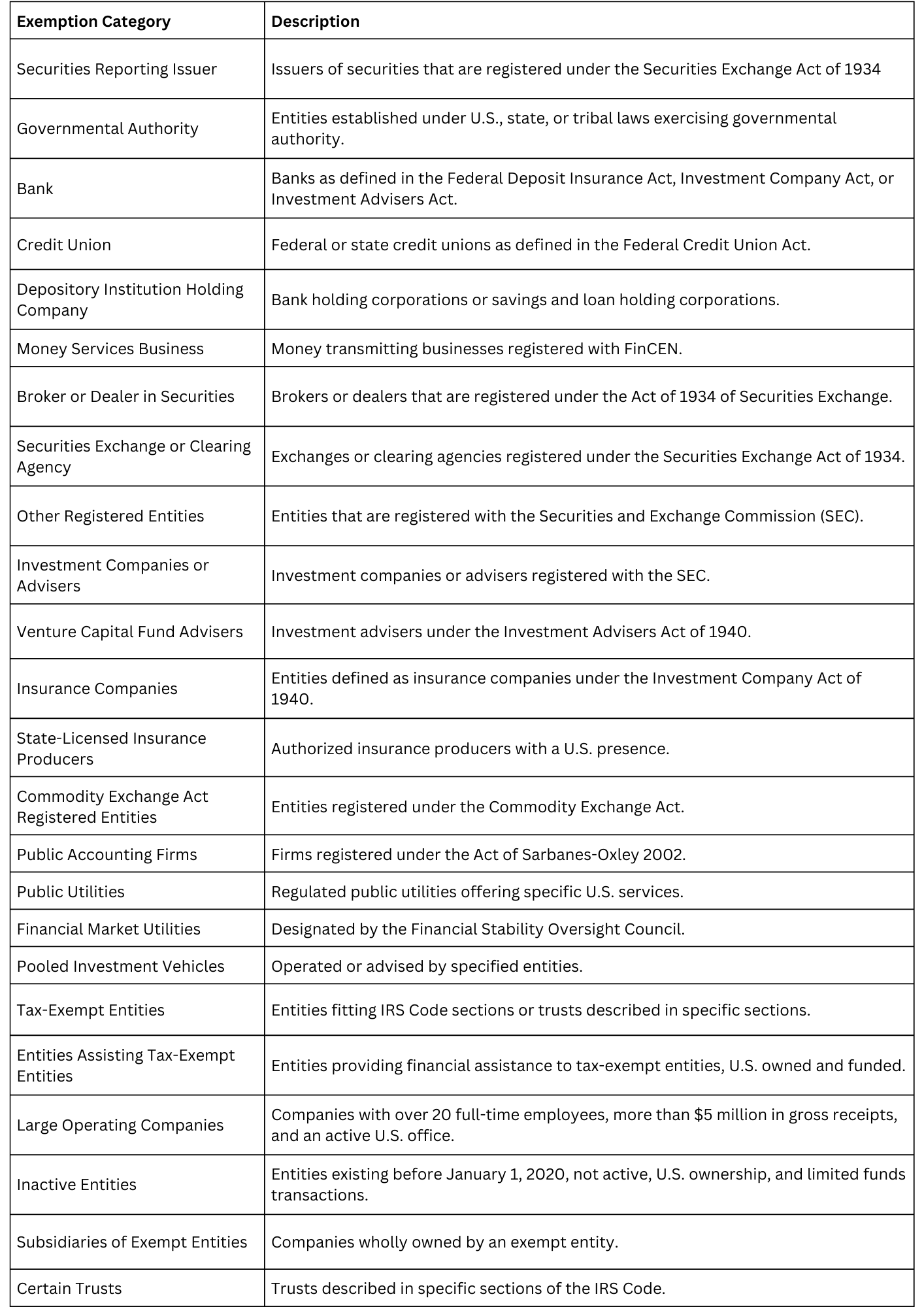

There are 23 exceptions to this rule, so it is crucial to go through the list carefully.

What is a Beneficial Owner of a Company?

A beneficial owner is known as an individual who has the right to get benefits via the ownership of a company even if the company shares or title to the property is in the name of another individual. This individual has the power to vote or influence the transaction decisions regarding a specific security, such as shares in a company.

Typically, a beneficial owner has 25% or more ownership control in a company. Ownership interests can include:

- Equity, stock, or voting rights

- Any interest in the assets or profits of a company organized as an LLC, which is similar to stock in a corporation and sometimes referred to as a ‘unit’.

- Convertible instrument that can be convertible into stocks, equity, or voting rights OR capital or profit interests.

- Any put, call, straddle, or other option or privilege of buying or selling equity, stock, voting rights, capital or profit interest, or convertible instruments, except if the option or privilege is held by someone else with no involvement or knowledge of the reporting company

- Any other tool, contract, or method used to establish ownership

Also, a reporting company can have different types of ownership interests.

An individual can be a beneficial owner either through substantial control, ownership interests, or both. However, reporting companies don’t need to specify whether the beneficial ownership is due to control or ownership interests.

Now, let’s understand what substantial control is.

What is Substantial Control?

Substantial control refers to individuals who have significant influence over a reporting company. According to the Corporate Transparency Act (CTA), an individual exercises substantial control over a reporting company if they meet any of the following criteria:

- They are senior officers like the President, Chief financial officer (CFO), General Counsel (GC), Chief executive officer (CEO), and Chief operating officer (COO)

- They have the power to appoint or remove any senior officers or a majority of the company’s directors.

- They play a key role in making important decisions.

- They hold any other significant control over the company and its decisions such as Business, finances and structure.

There is no limit to the number of individuals who can be reported as having substantial control.

What are the Deadlines for Filing Beneficial Ownership Information (BOI)

The deadlines for filing Beneficial Ownership Information (BOI) in the U.S. are as follows:

- Existing Companies: Companies that were created or registered to do business in the U.S. before January 1, 2024, need to submit their initial BOI report by January 1, 2025.

- New Companies: Reporting companies created or registered to do business in the U.S. on or after January 1, 2024, must file their initial BOI report within 90 days of receiving actual or public notice that their company’s creation or registration is effective.

What Happens If a Company Does Not Report BOI?

If a company in the U.S. fails to report its Beneficial Ownership Information (BOI) within the required timeframe, it can face significant penalties. Here are some of the consequences:

- Civil Penalties: Companies can be fined up to $500 for each day the violation continues.

- Criminal Penalties: Willful non-compliance can result in fines up to $10,000 and/or imprisonment for up to two years.

These penalties are part of the Corporate Transparency Act (CTA), which aims to combat financial crimes like money laundering by requiring companies to disclose their beneficial owners.

Also, an individual may also face civil and/or criminal penalties for intentionally causing a company to avoid filing a required BOI report or for submitting incomplete or false beneficial ownership information to FinCEN.

Conclusion

The Beneficial Ownership Information Reporting Form (BOIR) is crucial for keeping financial activities transparent and fighting financial crimes. Knowing who needs to file, how to complete the form, and the benefits of accurate reporting can help companies in the long run.

If your company is looking for accounting and bookkeeping services or payroll accounting in the US, you can opt for GJM & Co. Our team of taxation accountants & CPA accountants cater to your payroll management, Business Formation, Taxation, Virtual CFO, and more. To file BOIR or any queries, email us at info@gjmco.com or schedule a call.