Governments, companies, and foundations give business grants to help and support businesses. Unlike loans, there is no need to repay grants, which makes them an attractive funding source for entrepreneurs and established businesses alike. They play a crucial role in encouraging entrepreneurship, driving innovation, and stimulating economic development across various sectors.

This article provides a comprehensive overview of grants available to U.S. businesses, categorised into federal, state, corporate, industry-specific, and minority-owned business grants. We will also discuss U.S. grants accessible to businesses outside the United States. Let’s start!

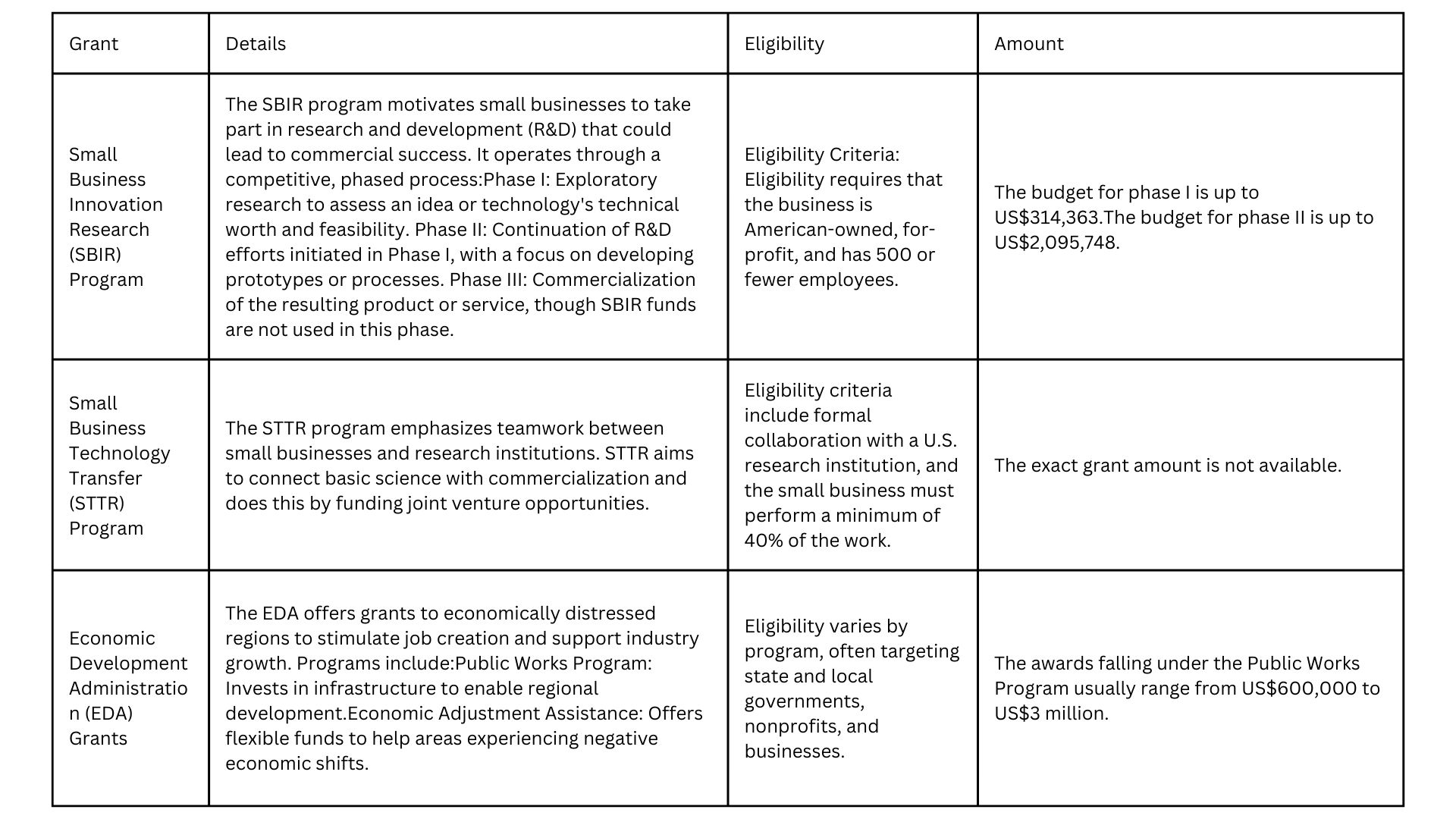

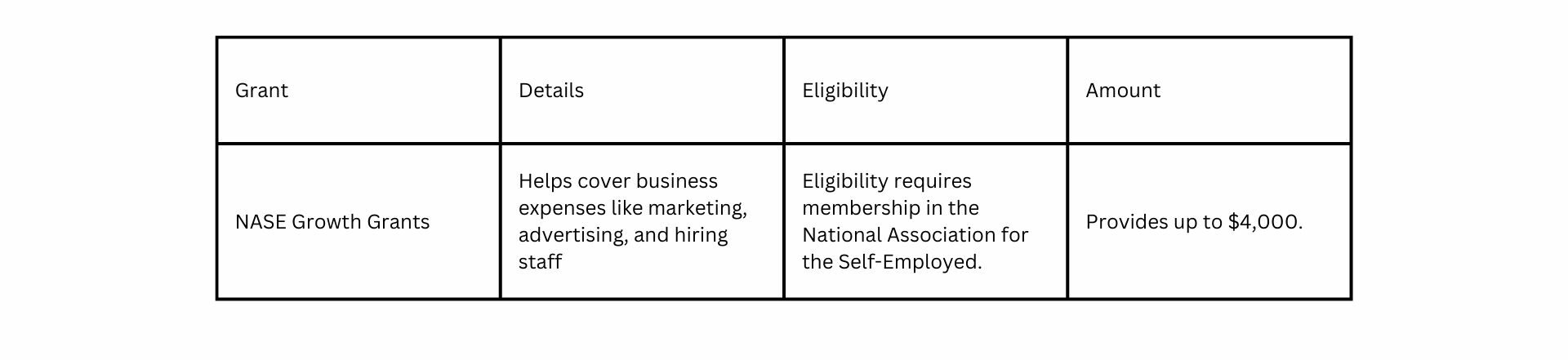

Federal Grants for Businesses

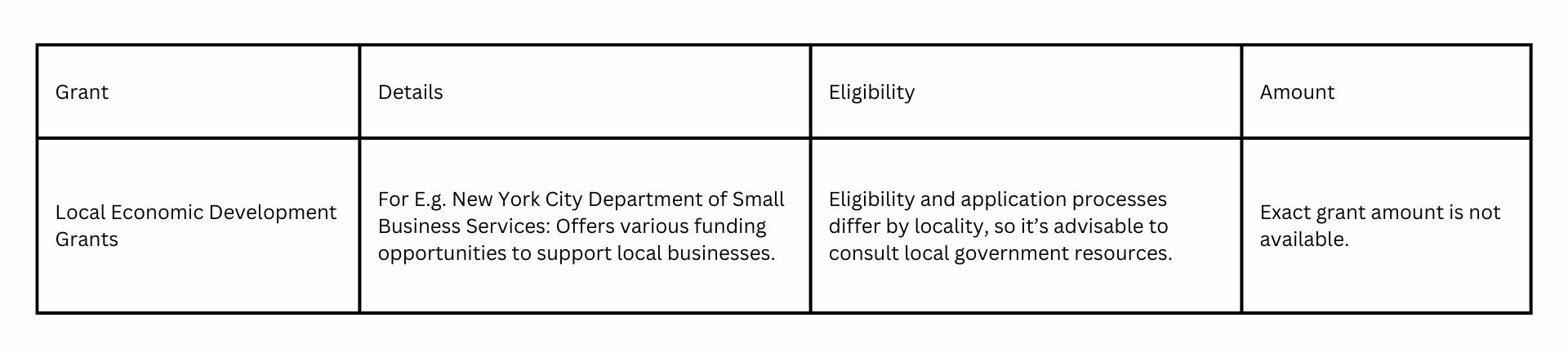

Local Grants for Businesses

City and county governments often provide grants to boost local economies. For instance:

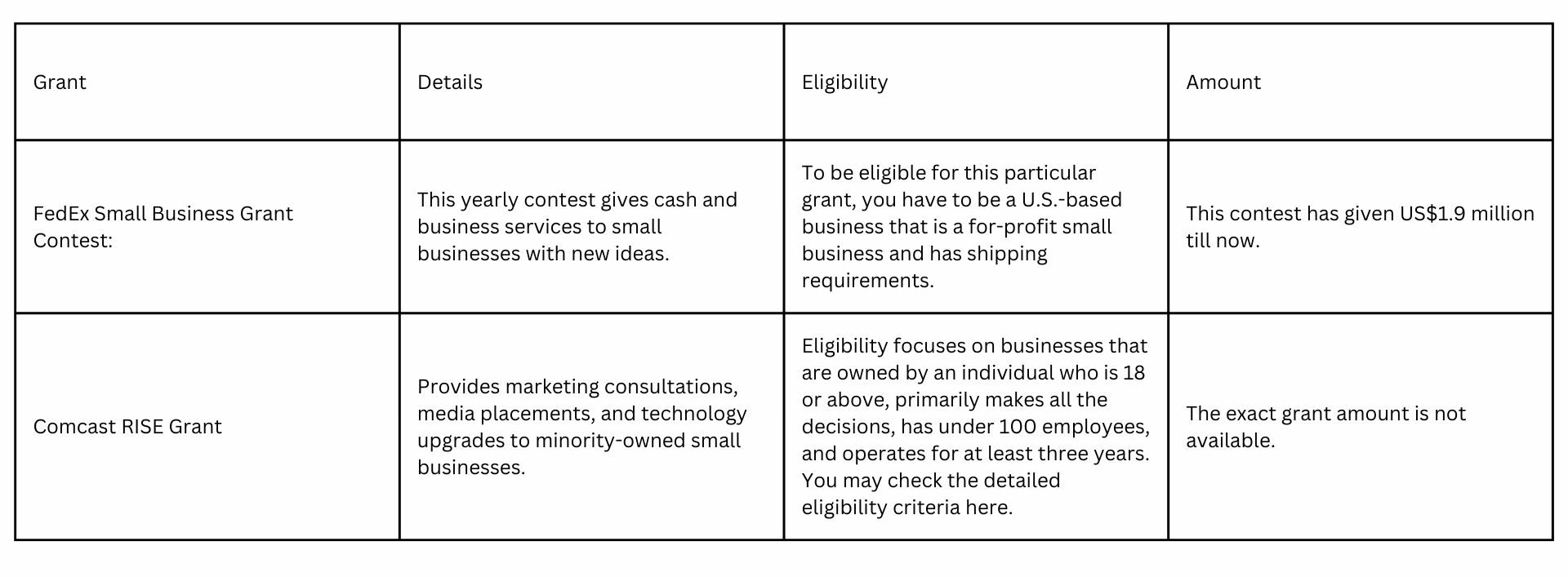

Corporate and Foundation Grants for Businesses

1. Corporate Grants

2. Foundation Grants

Industry-Specific Grants for Businesses

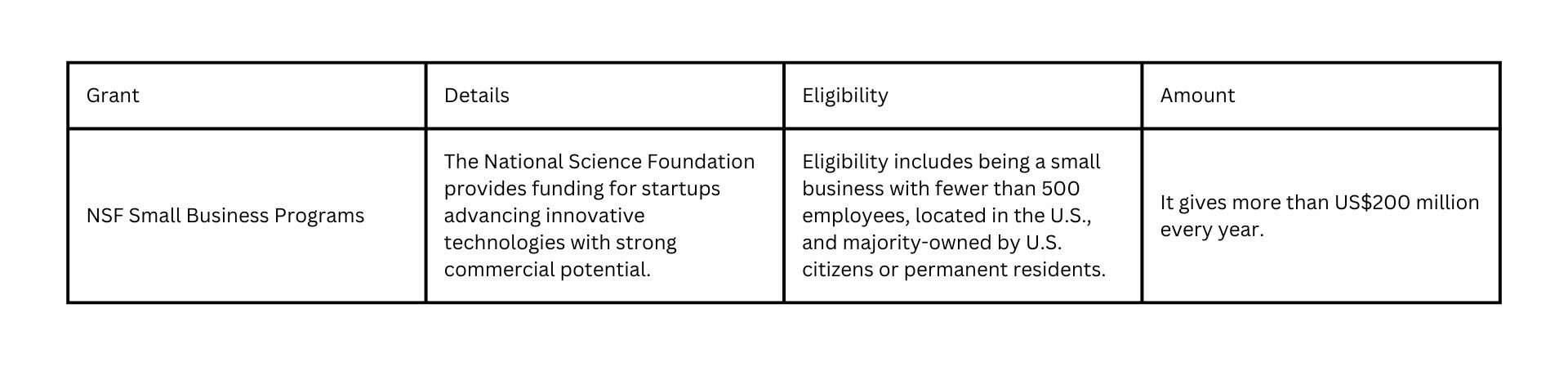

1. Technology and Innovation

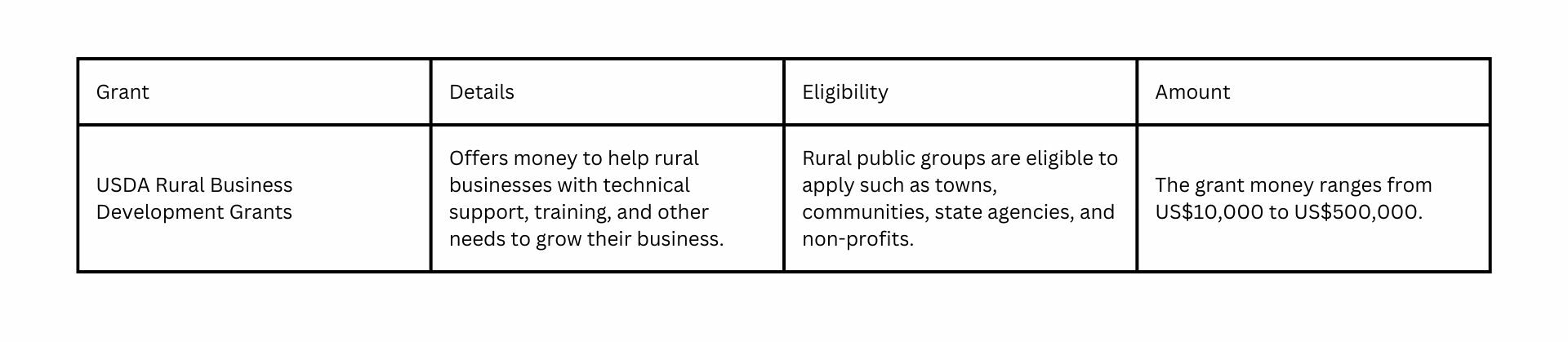

2. Agriculture Grants

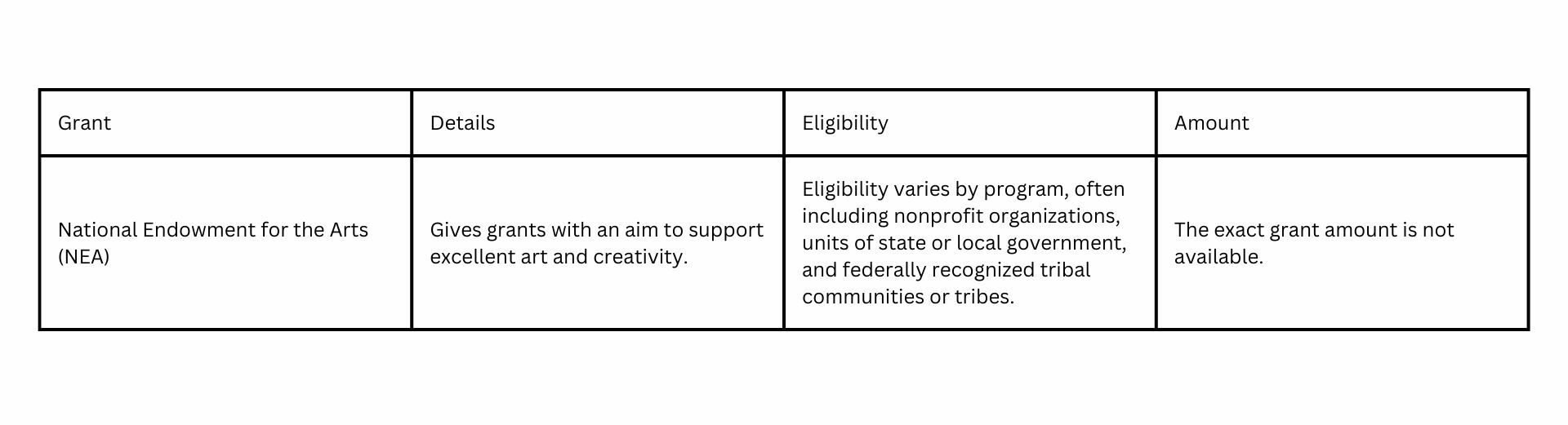

3. Arts and Creative Industries

Grants for Minority-Owned Businesses

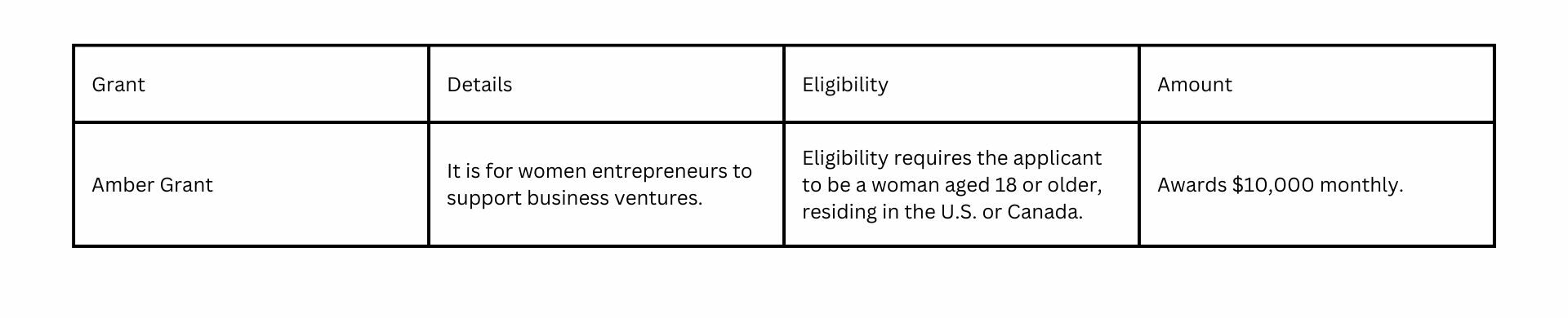

1. Grants for Women-Owned Businesses

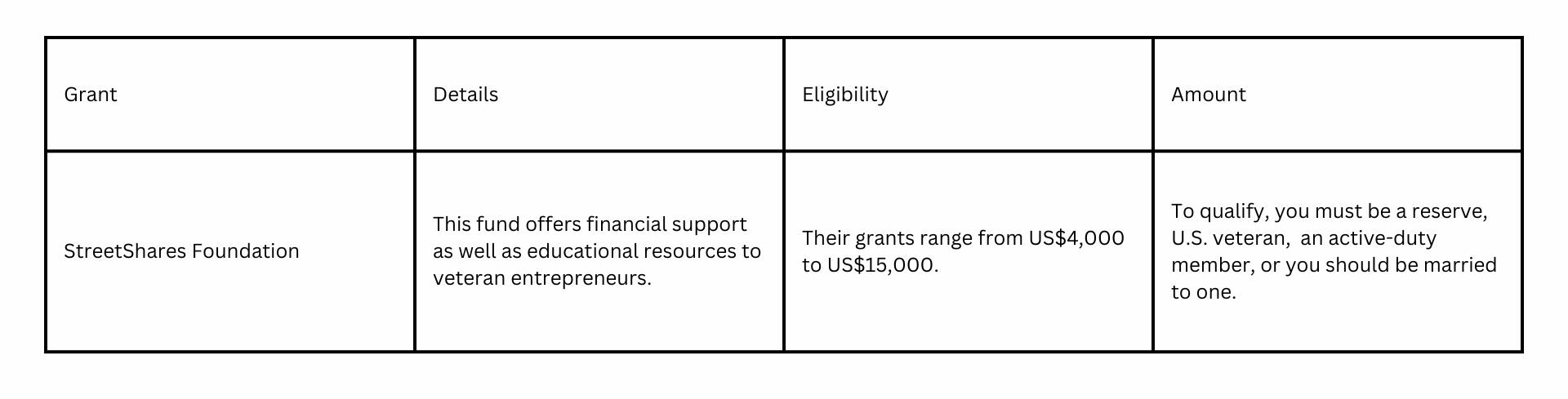

2. Grants for Veteran-Owned Businesses

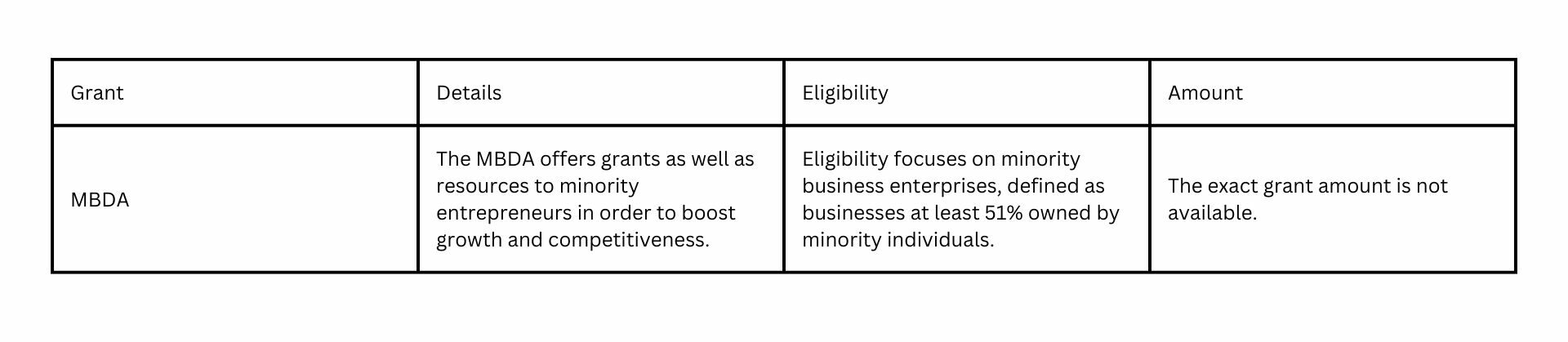

3. Minority Business Development Agency (MBDA)

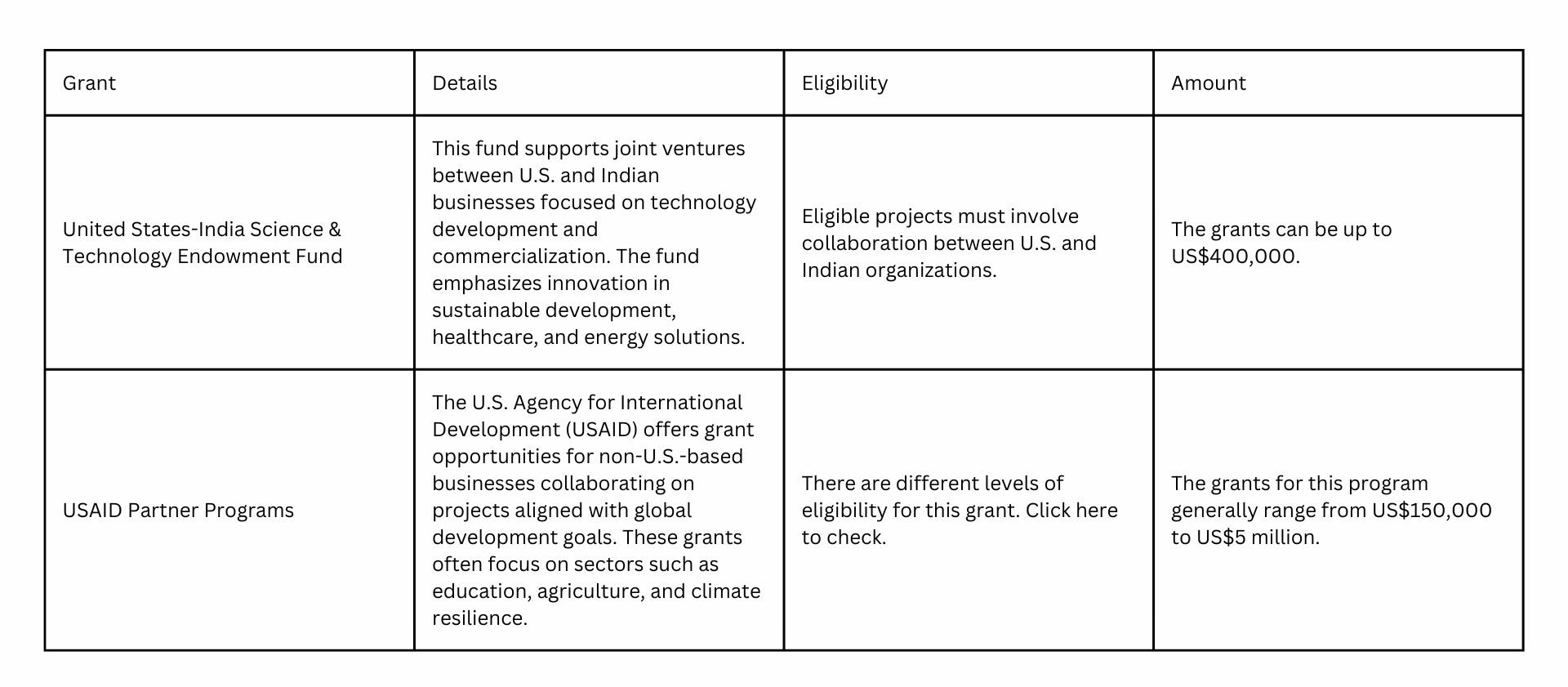

U.S. Grants for Businesses Outside the U.S.

While most U.S. grants target domestic businesses, certain programs extend to international enterprises:

Conclusion

The U.S. offers a vast range of grant opportunities to businesses across industries and demographics. Securing a grant can significantly impact a business’s growth and success. To begin the grant search process, visit resources such as Grants.gov, SBA, and state-specific economic development websites. Local Small Business Development Centers (SBDCs) also offer valuable guidance for navigating grant opportunities. By leveraging these resources and taking proactive steps, U.S. businesses can unlock vital funding opportunities to fuel their growth and innovation.

To make the process of funding smoother for your business, email us at info@gjmco.com or schedule a call. At GJM & Co, we provide you with a vast range of services including Taxation, accounting and bookkeeping, payroll accounting, payroll management, Business Formation, Virtual CFO, and more. Get in touch with us now.