Property management accounting in the United States operates within a complex framework that requires specialized knowledge and processes. This discipline addresses the unique challenges presented by the management of real property assets on behalf of owners.

In this regulatory environment, oversight comes from multiple directions. Federal regulations, including the Fair Housing Act and tax codes, establish baseline requirements. State-level oversight adds another layer, particularly regarding trust account management, where states like California, Florida, and New York maintain strict requirements for handling security deposits and rent payments.

To help you, in this article, we will cover everything you need to know about property management in the US.

Core Accounting Principles for US Property Management

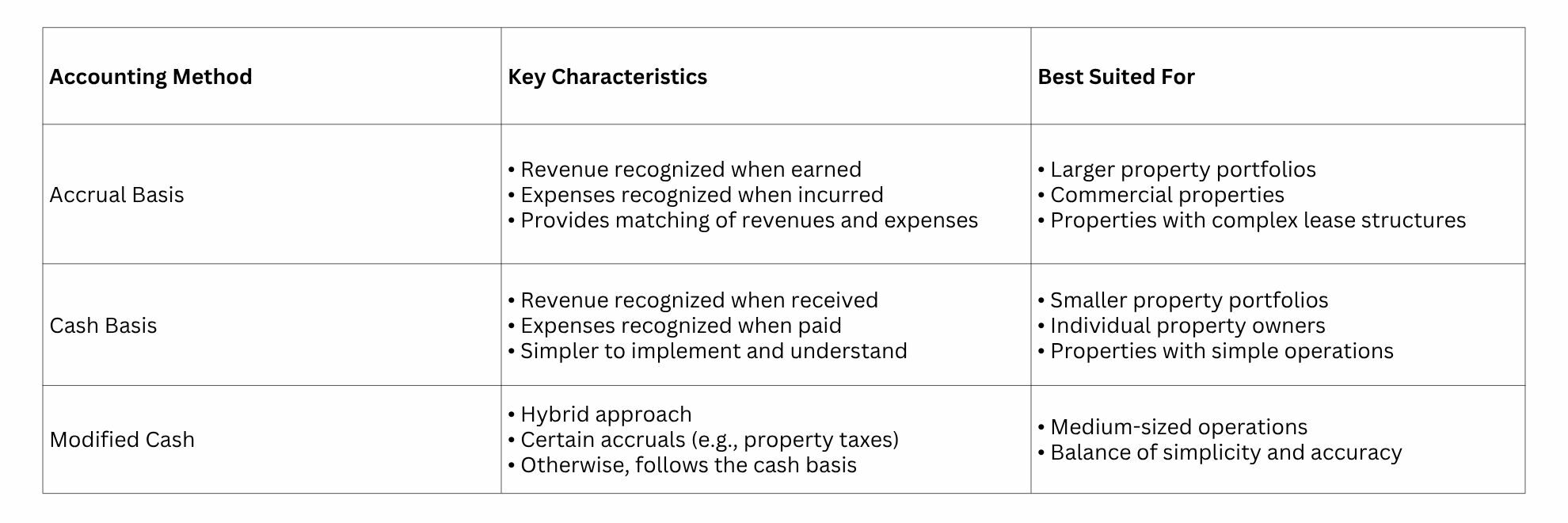

American property management accounting adheres to Generally Accepted Accounting Principles (GAAP) with industry-specific applications. The selection of an appropriate accounting method is fundamental to effective property management:

Security Deposit Management and Recognition

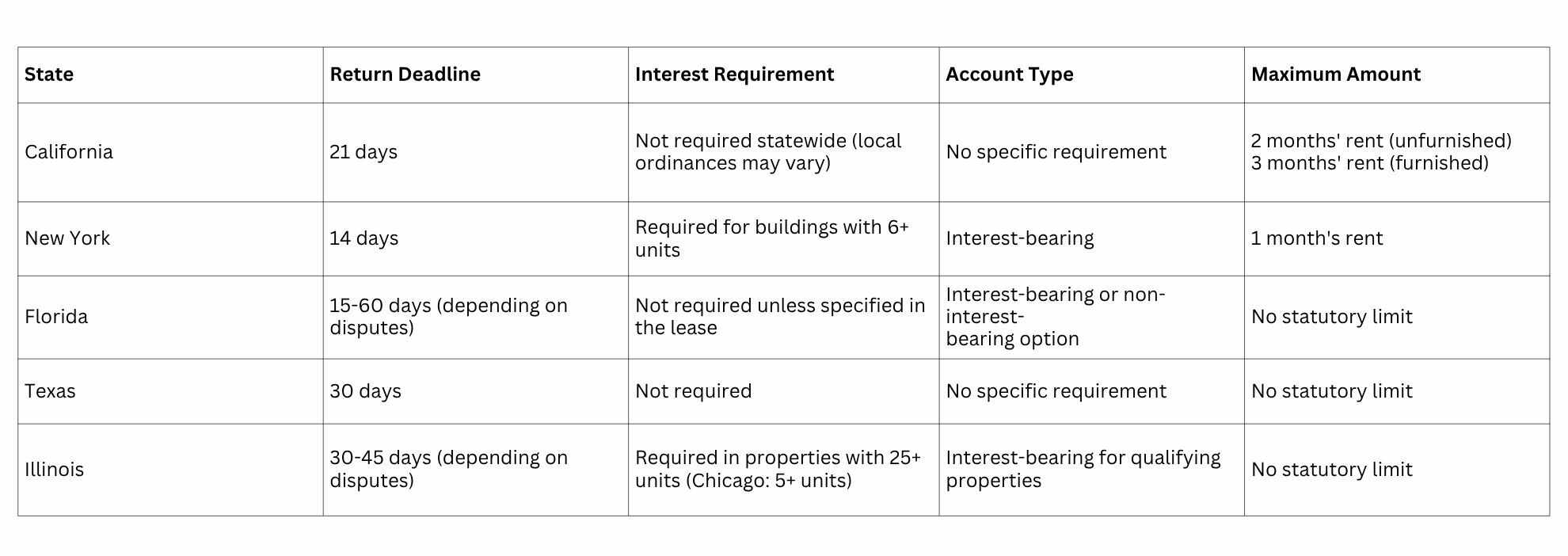

Effective revenue management requires systematic processes for collecting and accounting for various payment types, especially security deposit management. State regulations vary significantly regarding return deadlines, interest requirements, and maximum amounts.

In California, security deposits must be returned within 21 days of move-out, while Texas allows 30 days. Some states, including New York and New Jersey, require interest payments to tenants, while others permit managers or owners to retain interest earnings.

Security deposits must be properly classified on financial statements as liabilities rather than revenue, reflecting their contingent nature and eventual disposition requirements.

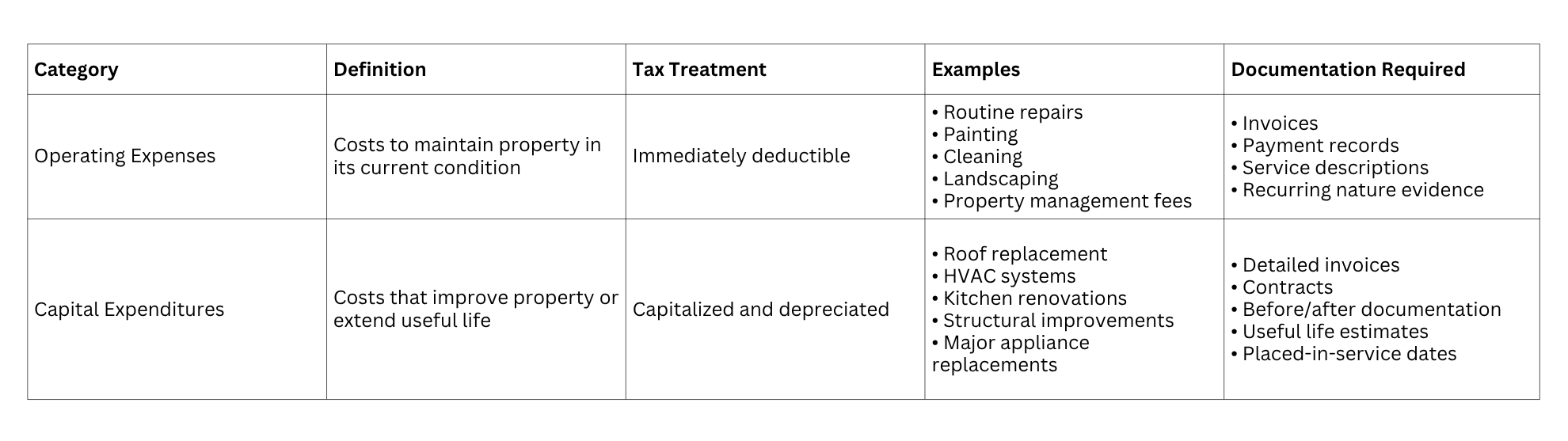

Expense Management and Categorization

Property management accounting requires precise categorization of expenditures between operating expenses and capital improvements. This distinction impacts both financial reporting and tax treatment.

The Internal Revenue Service provides guidelines to differentiate between repairs and improvements, though application in practice often requires professional judgment:

For tax planning purposes, property managers should utilize the de minimis safe harbor provision, which allows immediate expensing of items below certain thresholds ($2,500 per invoice for businesses without applicable financial statements).

Fixed Asset Accounting and Depreciation

When corporations and small businesses acquire significant physical assets manufacturing equipment, commercial real estate, etc., these purchases represent major capital investments.

Rather than expensing these acquisitions immediately, U.S. accounting principles and tax regulations require businesses to spread these costs across multiple reporting periods through depreciation.

Introduced through the Tax Reform Act of 1986, MACRS remains the standard depreciation system required by the Internal Revenue Service for most tangible property. MACRS encompasses two sub-systems:

- The General Depreciation System (GDS) applies to most properties and uses accelerated methods over shorter recovery periods. For instance, office furniture falls into the 7-year property class, while residential rental properties are depreciated over 27.5 years.

- The Alternative Depreciation System (ADS) generally employs longer recovery periods and applies exclusively to specific property types, including assets used predominantly outside the U.S., tax-exempt use property, and certain farm property. ADS mandates straight-line depreciation in virtually all cases.

MACRS implementation involves complex considerations, including placed-in-service dates, conventions (half-year, mid-quarter, or mid-month), and recovery periods that vary substantially based on asset classification. The resulting depreciation schedules yield front-loaded deductions that prove advantageous for tax planning purposes.

Section 179 Expensing

Section 179 expensing has transformed the depreciation strategy for small and mid-sized enterprises. This provision enables immediate deduction of qualifying purchases up to $1,250,000 in 2025, though benefits phase out for companies exceeding $3,130,000 in annual equipment acquisitions.

Bonus Depreciation

First implemented as a temporary economic stimulus measure, bonus depreciation has undergone numerous extensions and modifications. Unlike Section 179, bonus depreciation applies without dollar limitations and can create or increase net operating losses.

The Tax Cuts and Jobs Act of 2017 temporarily expanded this benefit to 100% for qualified property acquired and placed in service after September 27, 2017. However, a scheduled phase-out is currently underway:

- 80% for property placed in service during 2023

- 60% for property placed in service during 2024

- 40% for property placed in service during 2025

- 20% for property placed in service during 2026

- 0% thereafter (barring congressional action)

This declining benefit has prompted many businesses to accelerate capital expenditures to maximize available deductions before further reductions occur.

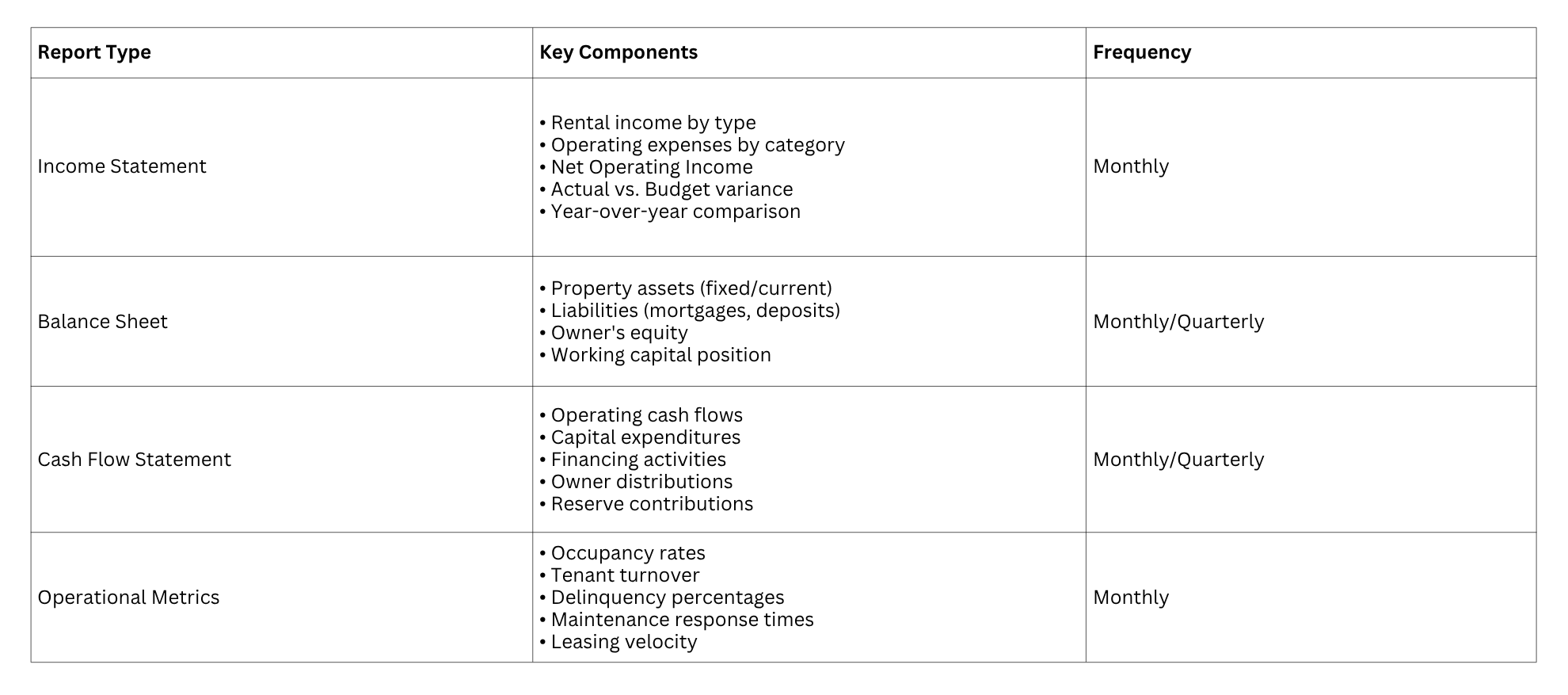

Financial Reporting for Multiple Stakeholders

Effective property management requires tailored financial reporting systems that provide relevant information to diverse stakeholders. Reports should be comprehensive yet accessible, providing both high-level performance indicators and detailed operational metrics.

Strategic Financial Management

Strategic financial management enables property managers to optimize asset performance and support owner objectives. This process includes:

- Budget development incorporating historical performance analysis, market trends, and planned capital improvements

- Performance monitoring through variance analysis and key performance indicators

- Investment analysis using metrics such as capitalization rates, cash-on-cash returns, and debt service coverage ratios

- Risk management through appropriate insurance coverage and reserve planning

- Tax optimization strategies leveraging depreciation benefits and available deductions

- Effective property managers utilize financial analytics to identify optimization opportunities and support evidence-based decision making.

For this, the services of accounting and taxation firms can be very useful and save time.

Conclusion

Property management accounting combines financial expertise with industry-specific knowledge to meet the unique challenges of real estate asset management. It requires a systematic approach for accurate reporting, regulatory compliance, and strategic decision making.

If you are also looking for a taxation and accounting management firm, consider GJM & Co. We offer comprehensive services related to accounting and bookkeeping, taxation, payroll accounting, payroll management, Business Formation, Virtual CFO, and more. Get in touch with us via info@gjmco.com or schedule a call.