Businesses thrive on numbers, but not all metrics hold equal value. Among the critical financial indicators, revenue and profit stand out as key metrics. Both revenue and profit are often used interchangeably, but these terms hold distinct meanings and implications for business operations and financial health.

In this article, we’ll explore the differences between revenue and profit, their importance, common misconceptions, and how businesses can assess what matters more in their financial journey.

What Is Revenue?

Popularly known as the top line, the total income generated by a company through its main operations is called revenue. This figure does not account for any expenses incurred during the process. It essentially indicates the gross income a business earns by selling goods, providing services, or engaging in other business activities.

Revenue is of two types:

- Operating Revenue: Income earned from core business activities. For example, a pharma company makes operating revenue from the sale of medicine.

- Non-Operating Revenue: Income earned from secondary activities, such as interest, dividends, or rent.

Revenue serves as a critical measure of a company’s ability to generate demand for its products or services. However, it does not provide insight into profitability, as it disregards operational and financial costs.

If you’re still confused, you can always count on the best accounting outsourcing company to manage your finances for you.

What Is Profit?

Profit, also known as the bottom line, is the financial gain that is left after deducting all expenses, including operational costs, taxes, and interest, from total revenue. You can consider profit as the main indicator of the efficiency and financial health of a company.

Profit is of three types:

- Gross Profit: You can calculate the gross profit by subtracting the cost of goods/services sold or COGS from revenue. It indicates how efficiently a company produces or sells its offerings.

- Operating Profit: Gross profit minus operating expenses such as rent, salaries, and utilities gives you operating profit.

- Net Profit: After all the deductions including interest and taxes take place, that profit is what we call net profit. It gives us an understanding of how profitable a business really is.

While revenue is essential for driving business operations, profit tells us whether a company is financially sustainable.

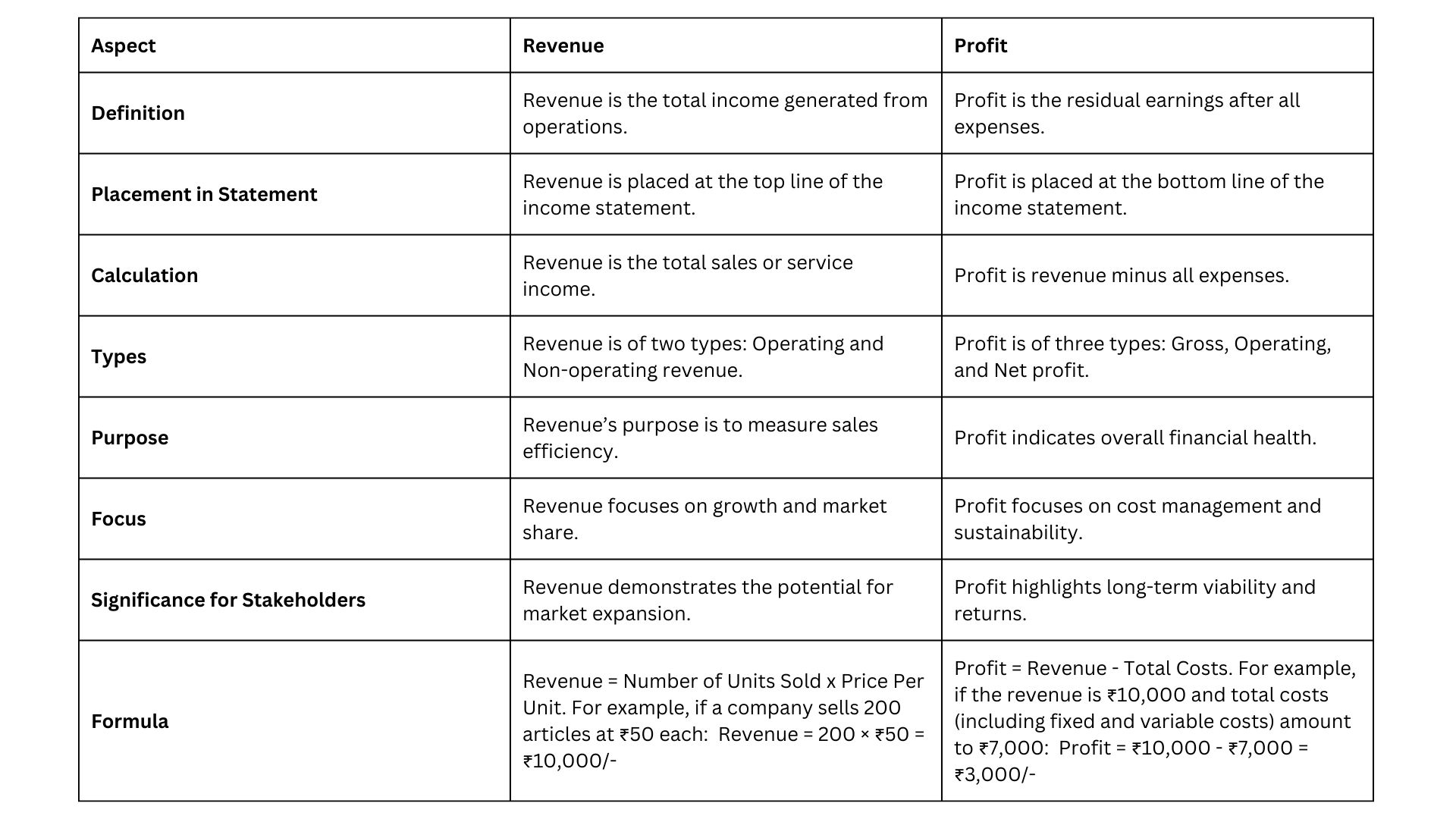

Key Differences Between Revenue and Profit

Although closely linked, revenue and profit serve different purposes in evaluating a company’s performance. Here’s a detailed comparison:

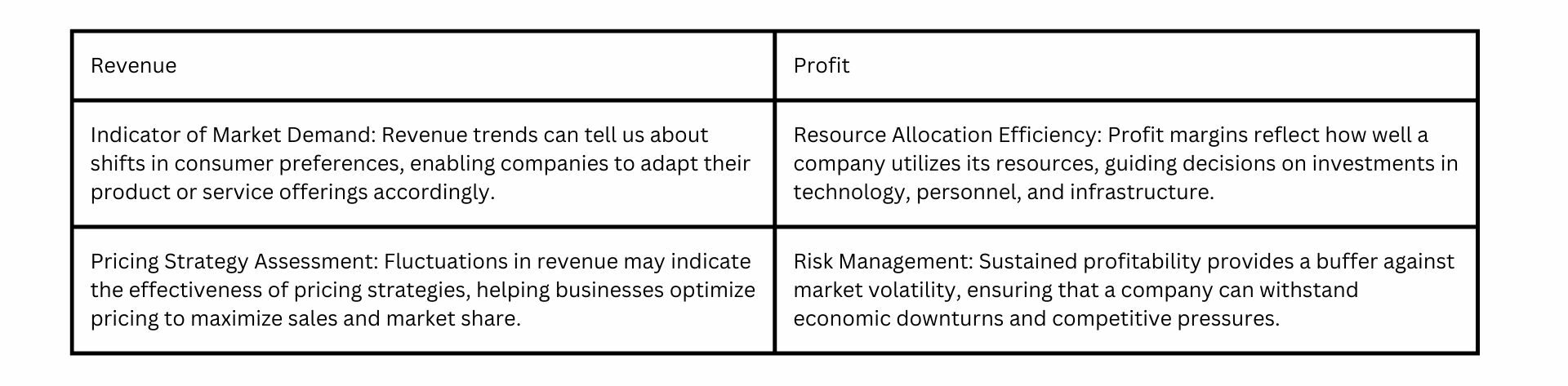

Why do Revenue and Profit Matter for Businesses?

Both revenue and profit are necessary for evaluating a company’s performance in different ways:

Investors and stakeholders often prioritize companies that develop a balance between revenue growth and profit generation, viewing them as more sustainable and resilient in the long run.

Understanding revenue and profit becomes clearer through examples:

High Revenue, Low Profit

Let’s say, a retail chain generated ₹500 million in annual revenue but reported a net profit of just ₹5 million. This difference was due to high operational costs, including rent and marketing expenses.

Moderate Revenue, High Profit

A technology startup with ₹50 million in revenue managed a ₹10 million net profit by keeping operational costs low and focusing on high-margin products.

These examples highlight the need to analyze both revenue and profit for a balanced and accurate view of financial performance.

For businesses, a balance between revenue generation and profit maximization is crucial for long-term success. Businesses can take the help of accounting and taxation services to help understand their financial position.

Common Misconceptions About Revenue & Profit

Despite their importance, revenue and profit are often misunderstood. One prevalent misconception is equating revenue with profit. Many believe that high revenue automatically translates into high profit. In real life, it is possible for a company to have very high revenue but low profit because of high expenses.

People also often overlook expenses without realizing that ignoring operational and financial costs can lead to inflated perceptions of financial health. Lastly, there is a misconception that profit can be higher than revenue. No, profit cannot exceed revenue. Revenue stands for the total income. On the other hand, profit is the remaining amount after deductions.

Since expenses are subtracted from revenue to calculate profit, it is mathematically impossible for profit to exceed revenue. Revenue takes the top line of the income statement, while profit appears as the bottom line, reflecting their sequential relationship in financial reporting.

The Interplay Between Revenue and Profit

Revenue and profit are interconnected measures that influence one another, but their relationship is very detailed. A company’s ability to turn its revenue into profit gives us an idea about its strategic priorities and operational efficiency. Let’s understand how they are related to one another:

Revenue Growth Without Profitability

Many businesses, especially startups, focus heavily on generating revenue at the cost of profitability. For instance, a business offering discounts or promotions to attract customers may see revenue spikes but reduced profit margins due to high marketing expenses.

Profitability at the Expense of Revenue

In contrast, a business aiming for higher profit margins might streamline operations, cut costs, or reduce product lines, which could limit revenue potential. While this strategy enhances short-term profits, it might hinder long-term growth opportunities.

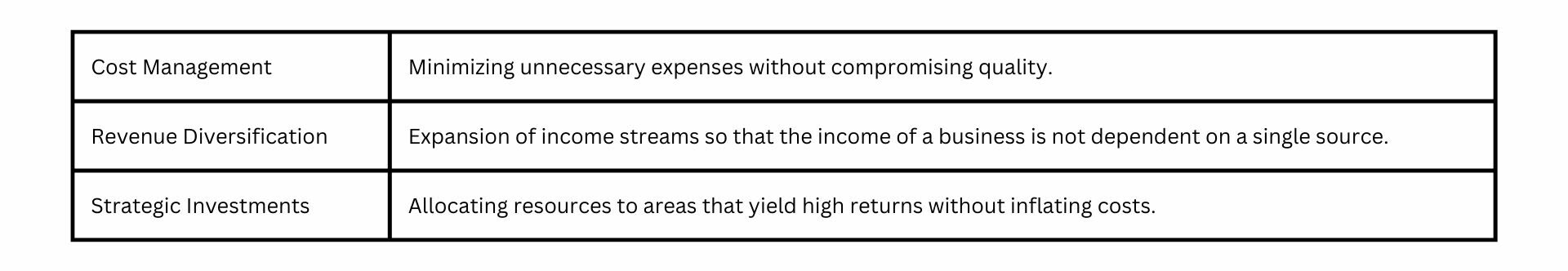

Balancing Both Metrics

The ideal scenario for any business is to grow revenue while maintaining or improving profit margins. Achieving this balance requires:

The importance of profit versus revenue depends on the business’s goals and growth stage.

- For Early-Stage Businesses: Revenue is often prioritized to establish market presence and scale operations. Initially, profitability may not be very prominent in the growth phases.

- For Established Companies: Profit becomes a key metric as businesses focus on sustainability, cost efficiency, and shareholder returns.

While revenue drives business activity, profit ensures that the operations are financially viable. A balance between the two is crucial to succeed in the long term.

By understanding the interplay between revenue and profit, businesses can make informed decisions to drive sustainable growth. This ensures not only financial health but also resilience in a competitive marketplace.

Conclusion

Revenue and profit are fundamental measures for any business, each serving distinct purposes. While revenue tells about a company’s ability to generate sales, profit highlights its financial sustainability and efficiency. The importance of both these measures depends on the growth stage of the business and its strategic objectives. By understanding the differences and analyzing both of them, businesses can achieve sustainable growth and maximize their financial potential.

To know more, get in touch with us at info@gjmco.com or schedule a call. We offer assistance and guide you through different prospects of business including Business Formation, Payroll management, Bookkeeping and Accounting services, Virtual CFO, etc.