Efficient financial management is important for the success of any business. One of the important aspects of this process is the Chart of Accounts (COA). A well-designed COA provides a framework for organizing financial transactions and supports informed decision-making to ensure regulatory abidance for a business.

In this article, we will cover what a COA is, how to use it effectively, and why it is crucial for businesses globally. Let’s start!

What is a Chart of Accounts?

A Chart of Accounts (COA) is a well-structured list (index) of all the financial accounts used by a business to keep track of its financial transactions. It acts as the backbone of the accounting system as it places transactions into distinct accounts for streamlined reporting and analysis.

Every account is assigned a unique identifier, typically a number or a combination of numbers and letters, for easy tracking and reference.

The COA is crafted to cater to the specific requirements of a particular business. This index gives an idea of the operational structure and financial reporting requirements of a business. By standardizing how financial data is recorded, a COA ensures consistency and accuracy in bookkeeping, enabling businesses to monitor their financial health effectively.

Structure of the Chart of Accounts

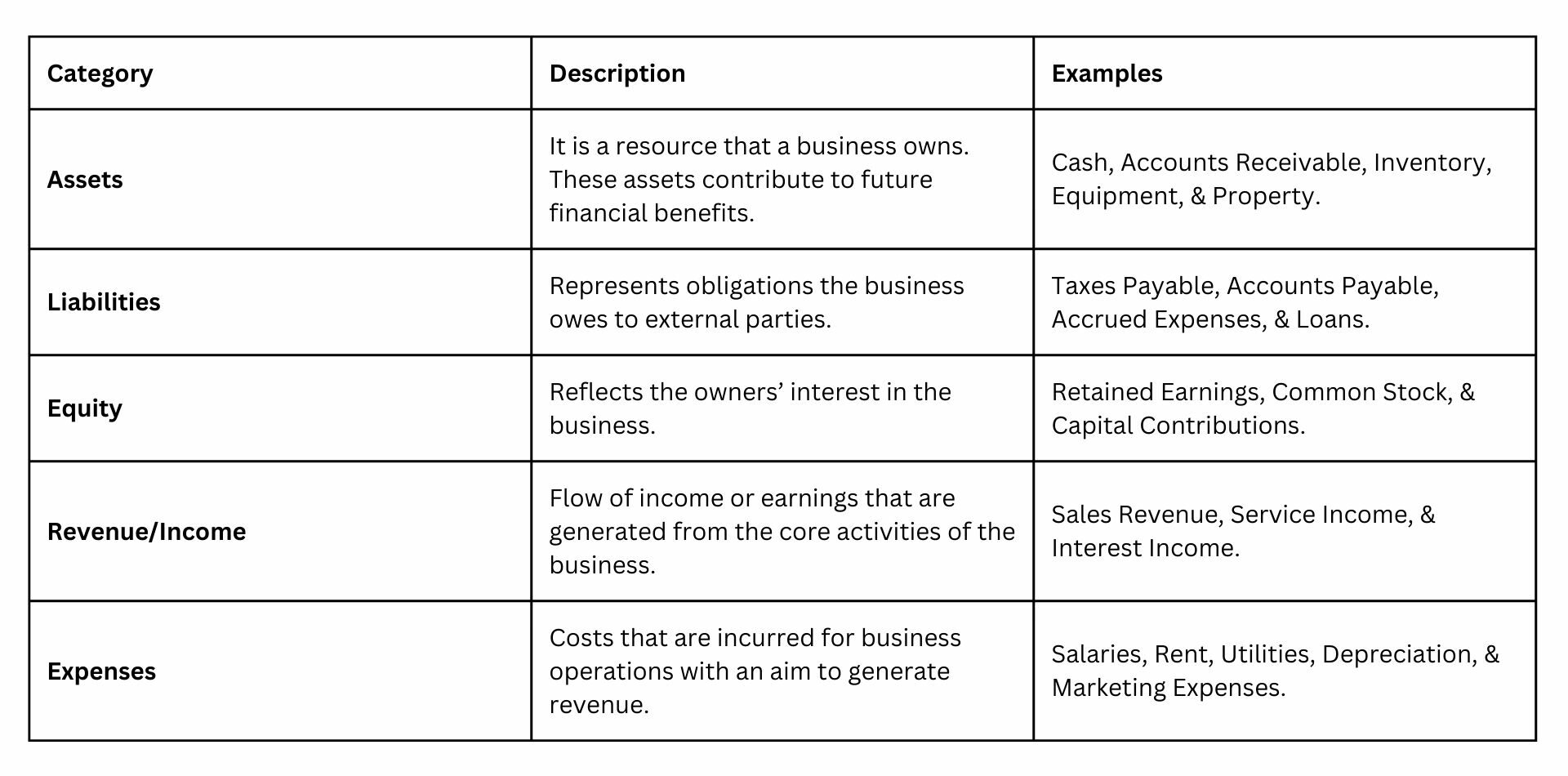

The Chart of Accounts is divided into primary categories that represent a key component of the business’s financial statements. Within these categories, subcategories further detail specific types of transactions. Below is a table summarizing the structure of a typical COA:

This hierarchical system helps businesses organize transactions logically and ensures clarity in accounting and bookkeeping. Each account is usually assigned a unique code, such as “1010” for Cash or “2010” for Accounts Payable which makes it easier to locate and analyze specific entries.

How to Use a Chart of Accounts?

A COA serves as a guide for recording and categorizing transactions in the general ledger. Its proper utilization requires consistent practices and alignment with the business’s operational needs. Here are the steps for using a COA effectively:

- Record Transactions: Each financial transaction is assigned to the appropriate account based on its nature. For instance, a purchase of office supplies would be recorded under “Office Expenses.”

- Categorize Revenue and Expenses: Use the COA to track income sources and operating costs, ensuring accurate profit and loss analysis.

- Generate Financial Statements: Data from the COA feeds into key financial reports like the balance sheet, income statement, and cash flow statement.

- Monitor Performance: Regularly review the categorized data to assess financial performance and make strategic adjustments.

You can outsource accounting functions to maintain an objective COA. Accounting software can also automate many of these tasks, reducing the risk of errors and enhancing efficiency.

Significance of a Chart of Accounts for Businesses

A well-structured COA is essential for businesses, offering multiple benefits:

- Enhanced Financial Management: By categorizing transactions systematically, a COA simplifies the process of recording and retrieving financial data. This organization is particularly crucial for businesses managing high transaction volumes or operating in multiple locations.

- Accurate Financial Reporting: Compliance with regulatory standards such as Generally Accepted Accounting Principles (GAAP) requires precise financial reporting. A COA ensures that all transactions are appropriately categorized, facilitating the preparation of accurate financial statements.

- Informed Decision-Making: A detailed COA provides insights into revenue trends, expense patterns, and profitability, enabling businesses to make data-driven decisions. For instance, a COA can help identify cost-saving opportunities or areas requiring increased investment.

- Streamlined Tax Reporting: A COA simplifies the process of preparing tax returns by clearly categorizing deductible expenses and taxable income. This organization reduces the risk of errors and ensures compliance with IRS requirements.

- Transparency for Stakeholders: Whether for investors, auditors, or regulatory authorities, a COA enhances transparency by providing a clear and consistent record of financial activities.

Best Practices for Managing the Chart of Accounts

An effective COA requires careful planning and regular updates. Here are some best practices for creating and maintaining a COA that supports business growth and compliance:

Tailor the COA to Business Needs

Every business is different, and its COA should also highlight its requirements in terms of operations and reporting. For instance, a retail business may need detailed sub-accounts for inventory categories, while a service-based business may focus on tracking different revenue streams.

Use a Logical Numbering System

Assign numbers to accounts systematically, grouping similar accounts together. A common approach is to use a hierarchical structure, such as:

- 1000–1999 for Assets

- 2000–2999 for Liabilities

- 3000–3999 for Equity

This system ensures that accounts are easy to locate and analyze.

Avoid Overcomplication

While it’s essential to capture all relevant financial data, an overly detailed COA can become unwieldy. Strike a balance by consolidating similar accounts while maintaining enough granularity for meaningful analysis.

Regularly Review and Update the COA

Business operations change with time, and the COA should adapt accordingly. Schedule periodic reviews to add, modify, or remove accounts as needed. For instance, introducing a new product line may require new revenue and expense accounts.

Ensure Consistency Across Departments

In businesses with multiple departments, ensure that all teams use the COA consistently. Standardized account names, codes, and usage guidelines prevent discrepancies and confusion.

Leverage Accounting Software

Modern accounting software often includes customizable COA templates that align with industry standards. These tools simplify setup and ensure compliance with GAAP or International Financial Reporting Standards (IFRS).

Involve Accounting Professionals

Take accounting consultation with accountants or financial advisors when designing or revising the COA. Their expertise ensures accuracy and alignment with regulatory requirements.

Employees responsible for financial data entry should be well-versed in using the COA. Offer training sessions to ensure they understand account categories, numbering conventions, and best practices.

By adhering to these best practices, businesses can maximize the benefits of their COA and maintain financial control.

Conclusion

A Chart of Accounts is more than just a list of financial accounts, it is a critical tool for organizing, analyzing, and reporting a business’s financial activities. For businesses, a well-designed COA ensures compliance with regulatory standards, enhances transparency, and supports strategic decision-making.

By implementing best practices and leveraging modern accounting bookkeeping tools, businesses can create a COA that evolves with their needs and contributes to long-term success.

If you are looking for accounting and bookkeeping and taxation needs for your business, consider GJM & Co. We offer you comprehensive services related to payroll accounting, payroll management, Business Formation, Virtual CFO, and more. To know more email us at info@gjmco.com or schedule a call.